Bank of Japan continues to surprise

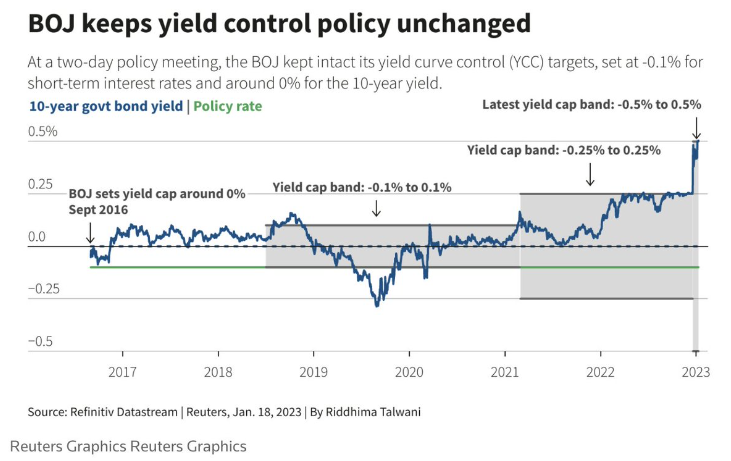

With the Bank of Japan (BoJ) surprising the market with an adjustment in monetary policy at the previous meeting in late 2022, the market speculated on the next move. The market was counting on the central bank to throw in the towel on Yield-Curve-Control (YCC). This YCC policy is not working as it has rather pro-cyclical effects. During the onset of the corona pandemic, 10-year interest rates fell, resulting in the central bank selling bonds to get interest rates back up. So that effectively means a tightening policy by the central bank, when an easing policy was in order. With inflation rising in Japan too, the central bank has to buy up bonds. So that is effectively an easing policy while rising inflation would require more of a tightening policy. In other words, YCC policy is unsustainable and the annoying thing is that the market has realised this.

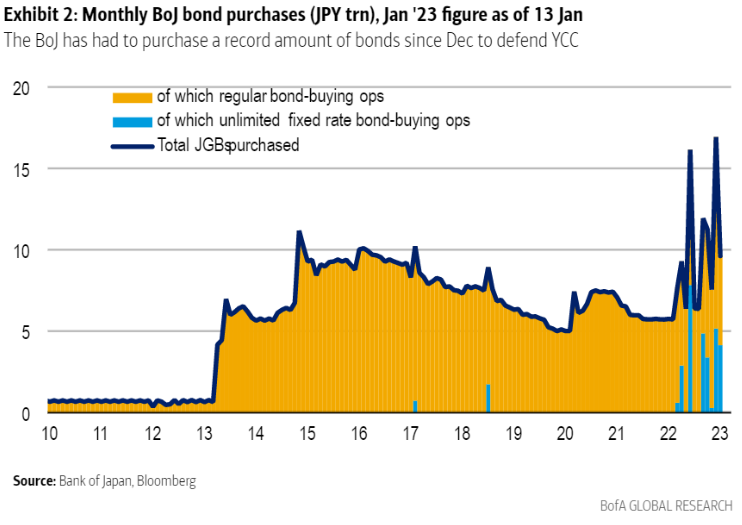

In speculation about the end of YCC policy, 10-year yields rose above 0.5 per cent. This meant that the BoJ was forced to buy up bonds en masse, providing additional stimulus to the economy. For a long time, the central bank did not have to do anything when interest rates were capped at 0.25 per cent. Because of its credibility, the central bank hardly needed to act. Now, the adjustment in policy is actually creating expectations that the policy will eventually end and speculation about that is rife. Still, the BoJ did not dare to take the step, but it will probably take that step in April when current chairman Kuroda leaves after 10 years.

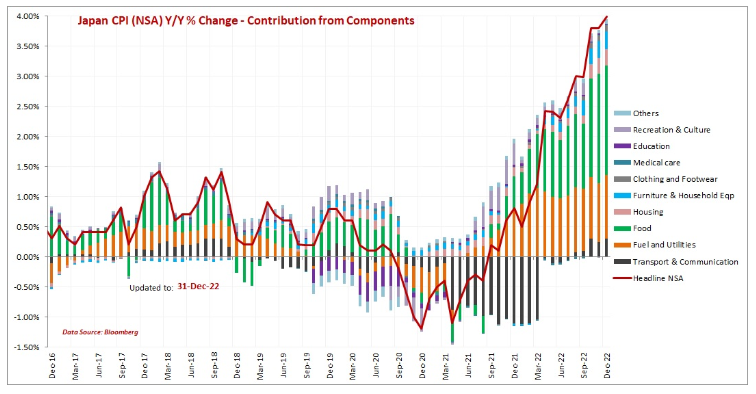

With YCC’s extremely stimulative policy (actually a step beyond quantitative easing) combined with rising inflation, it looks like it will soon be abolished. But because inflation has been so low in Japan for so long, the central bank also wants to keep inflation rising for a while. In any case, it seems that wages in Japan are starting to rise. First, the cost of raw materials rose. Those caused a trade deficit. Then the yen fell, causing more import inflation. Normally, inflation in Japan means that companies bear the extra burden first, but at some point that becomes unsustainable and companies do have to raise prices. And then higher wage demands follow. At Fast Retailing (the owner of Uniqlo), wages even increased by 40 per cent. Fortunately, the BoJ can also use YCC to tighten. Simply set the target for 10-year interest rates high enough so that there is a braking policy.

The good news about rising inflation in Japan – the highest point in 41 years – and rising interest rates is that with it, inflation is also getting back into the heads of the average Japanese person. Every Japanese now also gets it daily on the news. Inflation is now mainly driven by higher costs, but the goal is for the demand side to also create higher inflation. For this to happen, policy should not become too tightening in the short term.